Highland is our go to partner to research and develop business ideas for new innovations. They’re influential in how we orchestrate and conduct our work.

For Fintech Leaders & Startups: Amplify Growth By Bringing Customers Along

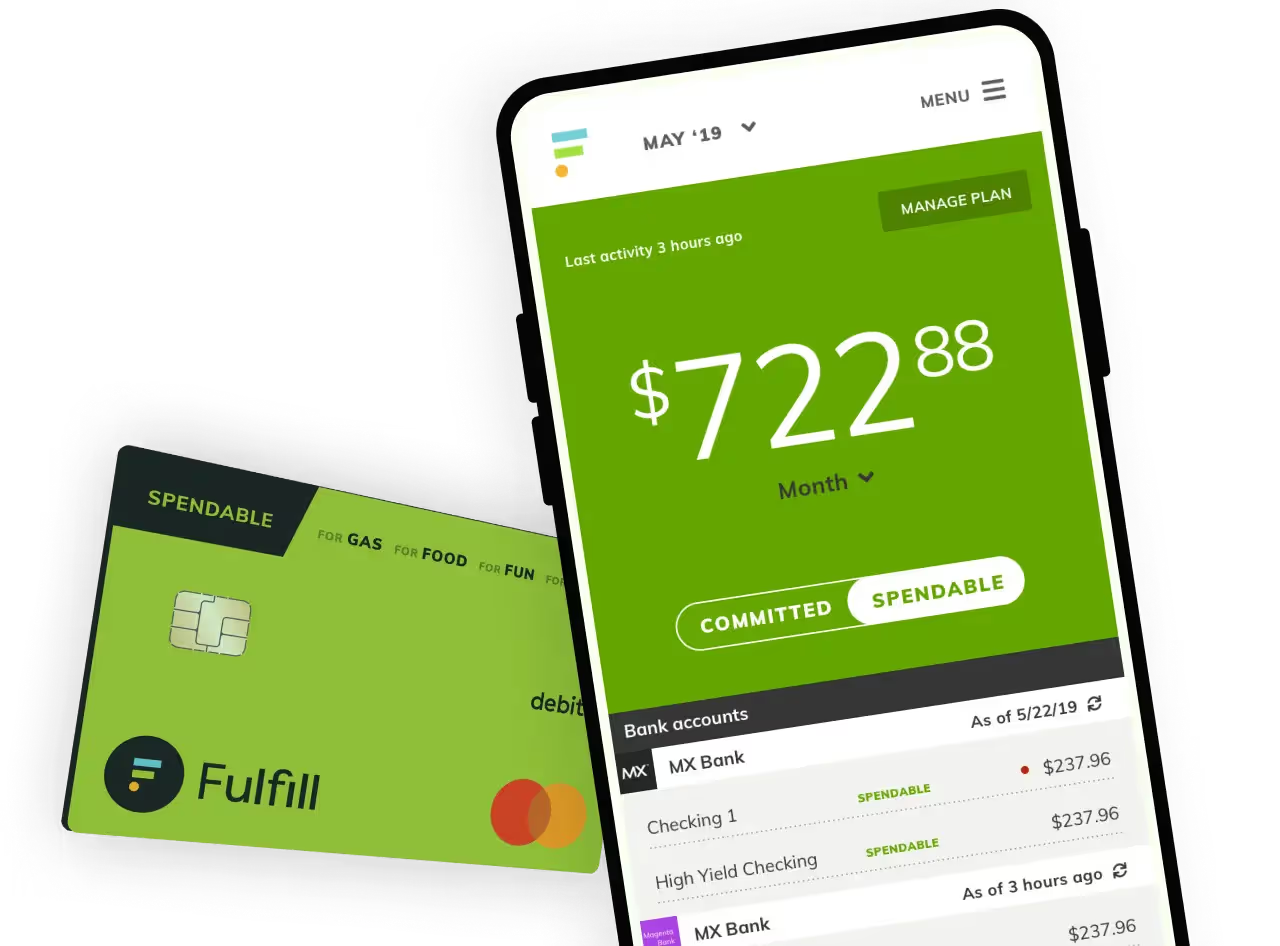

Deliver Delightful Experiences For a Mobile-First Mindset

Designing for the mobile-first mindset is crucial given the ubiquity of smartphones today, and seamless integration with everyday rhythms. Mobiles have become the new wallet. Challenges surface as businesses balance feature-rich experiences on web and mobile applications while being constrained by smaller screen sizes.

Highland utilizes continuous user feedback and research in user context so as to avoid the trap of assuming customer satisfaction based on UX designers’ intuition. Through qualitative, quantitative, responsive, and behavioral methodologies in our development projects, we’re able to deeply understand the circumstances and situations for which we’re designing, and offer digital experiences accordingly.

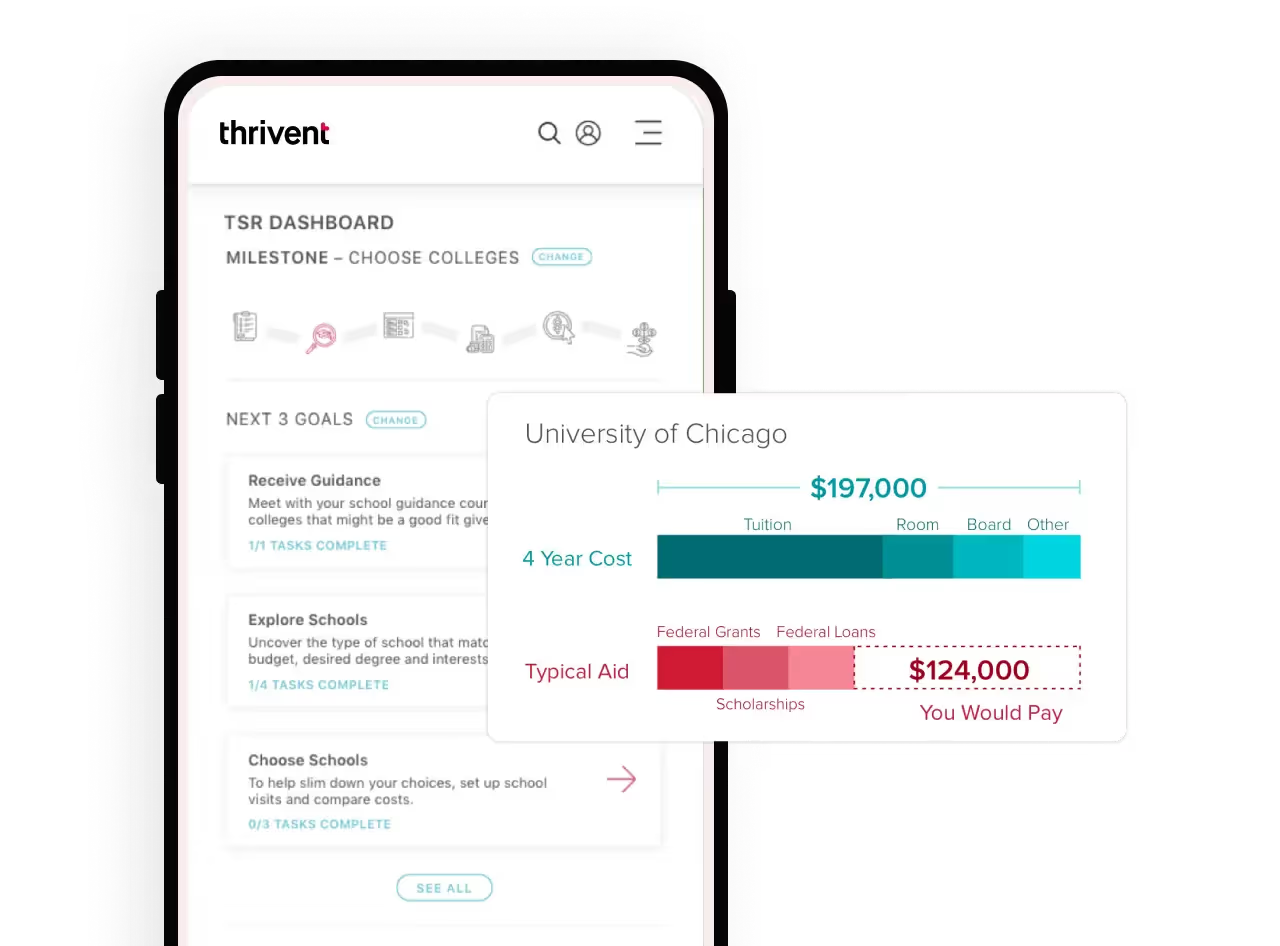

Boost Adoption By Building Trust and Financial Literacy

Disruptive innovations using cutting-edge technology can be met with skepticism and fear, prompting a need to educate and build trust with users before they’re ready to engage. Cybersecurity, fraud detection, use of personal data and GDPR, and protection of financial data are all legitimate concerns for users. Clearly communicating the purpose, value, and benefits of a digital banking solution can make or break its success.

Highland’s research, design, and build process strives to keep the user at the center of every feature and interaction, attempting to foster a sense of security, reliability, safety, and confidence throughout. We develop educational content and tools within banking apps and platforms, to make complex financial concepts understandable and engaging.

Design For Accessibility Right at The Start

Ensuring fintech products (like mobile banking) are accessible to all users, including those at varied levels of digital literacy or those with disabilities, is not just a moral imperative and regulatory requirement, but also a growth opportunity. It’s an often overlooked aspect of platform and app development.

All the way through the end-to-end development process, Highland seeks insight and feedback from users with varied digital abilities. Designing thoughtfully for the extreme users ensures greater customer satisfaction and adoption across all users, as well as higher quality assurance.

For Financial Services Providers: Embrace Digital Transformation Thoughtfully With User-Centered Design

Overcome Behavioral Resistance Through Compelling Design

Financial behaviors are deeply ingrained and can be resistant to change, especially in the context of traditional banking and financial industry. Encouraging users to adopt new technologies or platforms requires overcoming skepticism and habit inertia.

Highland’s design and research process is able to uncover behavioral insights for reliable learning, enabling more dependability in uncovered opportunities and value propositions. Through behavior-based enquiry methodologies, we’re able to gain a deep understanding of users’ motivations, biases, push-and-pull forces, and obstacles, subsequently designing for highly moving and compelling experiences.

Integrate Meaningfully With Existing Legacy Systems

Many new and evolving financial services need to integrate with existing legacy systems and content models. Ensuring a seamless user experience while dealing with the limitations of older technologies can be a challenge. Frequently, complexity in the back end inevitably translates to complexity in user flows and interactions.

Highland has deep experience with digital transformation that modernizes legacy systems without disrupting ongoing operations. Through a systems lens, broad stakeholder dialogue, and cross-functional collaboration, we work to achieve interoperability between different platforms and systems.

Increase Cost Effectiveness and Efficiency with Business Process Automation

Automate and digitize business processes, workflows and tasks like financial data processing to streamline and optimize efficiency. This can also encompass vulnerability and fraud detection. In turn, you can reduce operating costs and free up your teams to focus on other business goals.

Highland has vast expertise in custom financial software development, working collaboratively with in-house teams to ensure high quality end products. Our management software solutions have transformed companies, not just in the financial industry but also in healthcare and education.

Nurture Success With Continuous Improvement

Continuous improvement is key in today’s rapidly evolving finance realm. Success with one cycle of digital transformation doesn’t guarantee continued relevance for the future. Scalability and continually reinventing your digital service offering, refining the user experience, and seeking collaborative partnerships with emerging fintech companies is a critical part of product development.

Highland is well-versed in deploying mechanisms for collecting continual user feedback, allowing for iterative designs and prototypes that evolve based on actual user experiences and needs. Through exploratory qualitative studies, quantitative feedback loops, or product analytics, we harness learning and convert that into actionable and impactful change for your organization and the achievement of its business goals.